If you are frustrated with the returns earned from your savings accounts, perhaps it is time you consider taking your first step into the world of investing.

Tip #1: Planning

Before you start investing, consider your:

a. Financial goals

Set a clear goal of what you want to achieve by investing. You may set more than one goal. Are you looking to grow your money or generate income? For example, are you investing for your retirement (growth), or are you looking for a source of passive income (long-term)?

b. Time frame

After you have determined your goals, set a time frame for when you would want to achieve them. From there, you can figure out the rate of return required in order to achieve your investment goals within the set timeline.

c. Risk appetite

Understanding the risks, as well as your ability to stomach them (i.e. if you lost your capital) will have an impact on your financial strategy. If you want your money to grow significantly over a shorter period of time, be prepared to invest in riskier assets to achieve that growth. However, if the potential downsides are greater, you may have to consider realigning your goals.

d. Affordability

Be realistic about how much you can afford to invest. Assess all your liabilities, such as debts, insurance premiums and living costs, to see how much cash you actually can afford to invest.

ip #2: Always start with the basics

Often times, novice investors mistakenly believe that to make real money in the market, you have to invest in individual stocks. But that’s not actually true. There have been many investors who have made their fortunes using unit trust funds (UTFs) and exchange-traded funds (ETFs), and these vehicles are a great way to make investing for beginners an easier process.

UTFs and ETFS tell you exactly which stocks you own and in what proportions, which gives you predictable exposure to the stocks of your choice. You can also adjust your risk level as you get closer to your goals.

Although avoiding individual stocks can be a smart move for novices, there is an alternative way for beginners to invest. If you focus on stocks that tend to be less volatile than the overall market, you can get specialised exposure to stocks that have promising long-term prospects.

Types of stocks that you should look for are blue-chip stocks, those which are offered by large, prominent, stable companies with strong competitive advantages trading at reasonable valuations. In the Bursa Malaysia Kuala Lumpur Composite Index (KLCI), the top 30 companies by market capitalisation are mostly banks, food and beverage sector, and telecommunications sector companies.

Tip #3: Invest regularly to minimise losses

It is impossible to pick the perfect moment to invest in or to beat the market. You will never consistently buy at the lowest point and you will never consistently sell at the highest. We recommend you improve your chances of maximising returns by drip-feeding your money into a fund on a regular basis (once a month), rather than investing a lump sum. This is also known as Ringgit cost averaging.

For example, supposing you invest RM200 monthly in your UTFs or ETFs. When the market is up, your investment will give you less shares. When the market is down, your investment will give you more shares (due to the cheaper price). Over time, you would have averaged the cost of those shares and accumulated more shares. When the market goes up again, you will make more money.

Tip #4: Diversify

Most investing beginners may not be ready to put a lot of money into their investments. However, channelling all your hard-earned money into just one investment, stock or company is not the best idea either.

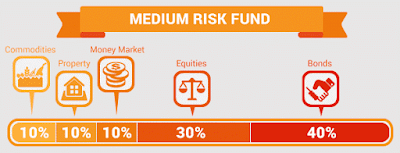

The best method of protecting capital is to diversify, which involves dividing up your lump sum across a portfolio and investing those portions into a variety of companies, asset classes or global markets. As some markets fall, others will rise and cancel out the losses. How you spread your money will be determined by your attitude to risk. For example, cautious investors shouldn’t invest too much in equities. Instead, opt for bonds or money market funds.

UTFs and ETFs will provide automatic diversification even if you have a lower capital. Every Ringgit you invest gets split across different stocks, protecting your portfolio against potential catastrophic events that can hit an individual stock. These are good investment products for individuals who don’t have enough assets or experience to manually create a diversified portfolio.

You are never too young to start putting away a small amount of money on a monthly basis for investing. The longer you invest, the more money you can potentially make. That is the beauty of compounding interest. Despite the possibility of ups and downs in the market, by starting to invest for example, at 25 versus 35, you will most probably end up with more money because you started earlier and were able to take full advantage of the compounding effect.

Time is a key ingredient in becoming a successful investor and maximising the benefits of compounding interest. So start smart, start right and start fast!

AZMI 019-2866 957

https://smartinvestingtip.wordpress.com/